2022 tax return calculator canada

The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada. The information deisplayed in the Alberta Tax Brackets for 2022 is used for the 2022 Alberta Tax Calculator.

Pin By Queen Mitchell On Manifest In 2022 Canadian Money Money Stacks Shmoney

203 on the portion of your taxable income that is more than 166280.

. The calculator reflects known rates as of January 15 2022. You simply put in your details get. The Canadian tax calculator is free to use and there is absolutely no obligation.

2022 Tax Return And Refund Estimator. This total is then used to determine how much you should get back in your tax refund or how much you owe the irs. Since April 30 2022 falls on a Saturday in both of the above situations your payment will be considered paid on time if we receive it or it is processed at a Canadian financial institution on or before May 2 2022.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This personal tax calculator does not constitute legal accounting or other professional advice. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

Select your province Employment income Self-employment income Other income CRB EI CPPOAS Capital gains Eligible dividends Ineligible dividends RRSP contribution Income taxes paid. The 2022 Tax Year in Ontario runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021.

This calculator is intended to be used for planning purposes. This marginal tax rate means that your immediate additional income will be taxed at this rate. If you filed your 2020 return and qualified for interest relief you have until April 30 2022 to pay any outstanding income tax debt for the 2020 tax year to.

Most people want to find out if its worth applying for a tax refund before they proceed. Shows combined federal and provincial or territorial income tax and rates current to. 2021 free Canada income tax calculator to quickly estimate your provincial taxes.

Meet with a Tax Expert to discuss and file your return in person. That means that your net pay will be 40568 per year or 3381 per month. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget.

2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. The 2022 Canada Tax return is completed as one single calculation except Quebec with the total tax calculations tax credits and exemptions centralised to simply tax. This means that you are taxed at 205 from your income above 49020 80000 - 49020.

Estimated balance owing. This handy tool allows you to instantly find out how much Canadian tax back you are owed. Any additional income up to 98040 will be taxed at the same rate.

Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. It includes very few tax credits. 8 rows Canada income tax calculator.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. 505 on the portion of your taxable income that is 46226 or less plus. The best starting point is to use the Canadian tax refund calculator below.

Calculate the tax savings your RRSP contribution generates in each province and territory. Go to Income tax rates Revenu Québec Web site. The Canada Annual Tax Calculator is updated for the 202223 tax year.

Find out your federal taxes provincial taxes and your 2021 income tax refund. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. Use Smartassets Tax Return Calculator To See How Your Income Withholdings Deductions And Credits Impact Your Tax Refund Or Balance Due Amount.

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Please enter your income deductions gains dividends and taxes paid to get a.

Average tax rate taxes payable divided by actual not taxable income. The Canada Tax Calculator provides State and Province Tax Return Calculations based on the 20222023 federal and state Tax Tables. The best free onl.

This calculator is for 2022 Tax Returns due in 2023. 2022 indexation brackets rates have not yet been confirmed to CRA data. Assumes RRSP contribution amount is fully deductible.

If you are looking to compare salaries in different provinces or for different. Start with a free eFile account and file federal and state taxes online by April 18 2022. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the.

We strive for accuracy but cannot guarantee it. 2021 Tax Calculator. It does not include every available tax credit.

Youll get a rough estimate of how much youll get back or what youll owe. 2022 Income Tax in Alberta is calculated separately for Federal tax commitments and Alberta Province Tax commitments. Use the Canada Tax Calculator by entering your salary or select advanced to produce a more detailed salary calculation.

Annual Tax Calculator 2022. 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax. The 2022 Tax Year in Alberta runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023.

Tax Refund Calculator 2022 Canada. 2022 RRSP savings calculator. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Stop by an office to drop off your documents with a Tax Expert. 1784 on the portion of your taxable income that is more than 145955 but not more than 166280 plus. Your average tax rate is 220 and your marginal tax rate is 353.

Canada Tax Calculator 202223. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. We strive for accuracy but cannot guarantee it.

This calculator is intended to be used for planning purposes. File your taxes the way you want. Reflects known rates as of January 15 2022.

Calculations are based on rates known as of March 16 2022. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator.

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

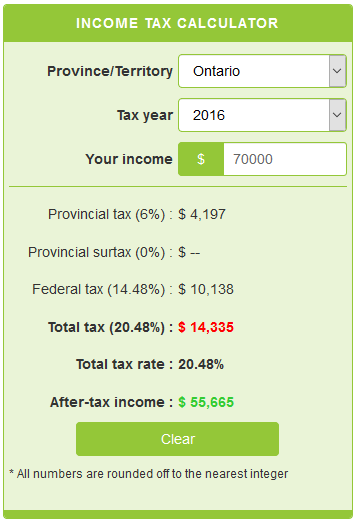

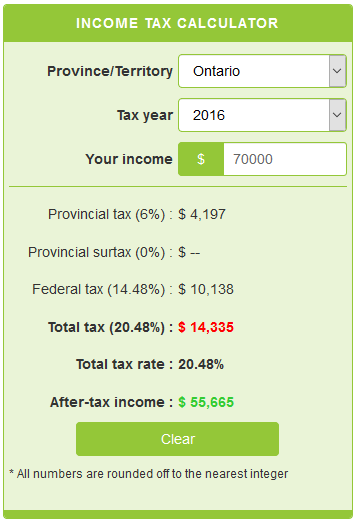

Income Tax Calculator Calculatorscanada Ca

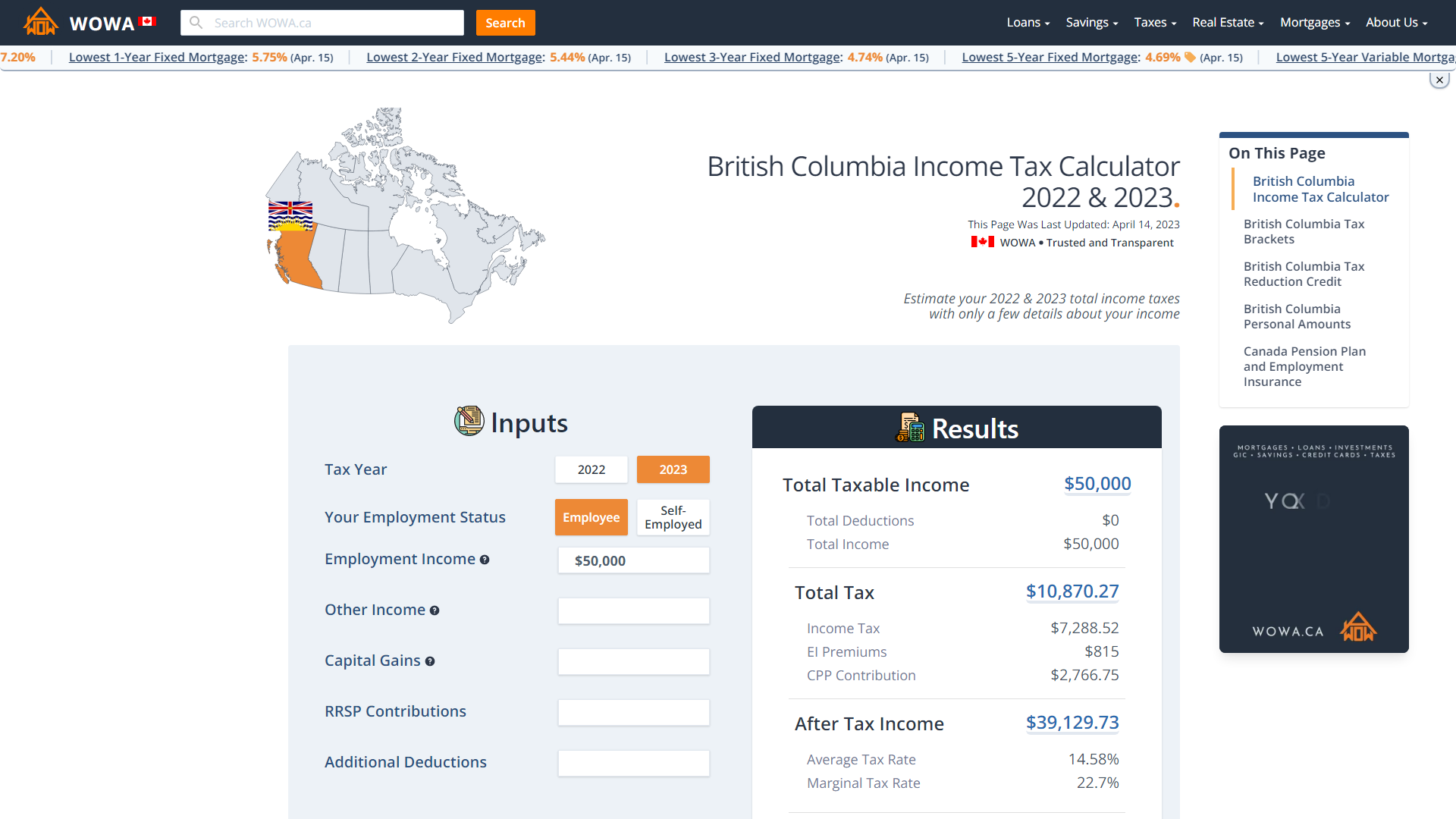

2021 2022 Income Tax Calculator Canada Wowa Ca

Reasons For Outsourcing Payroll In Singapore In 2022 Payroll Outsourcing Staff Management

Loan Flat Icons Set In 2022 Flat Icons Set Flat Icon Icon Set

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Simple Tax Calculator For 2021 Cloudtax

Pin On Awesome Blogs To Follow

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Meta Filing Taxes Income Tax Income

Capital Gains Tax Calculator 2022 Casaplorer

Online Payment Invoice Tax Bills Accounting Services Vector Isometric Concept Accounting Payment Isometric Pay Accounting Accounting Services Online Payment

Your 2022 Tax Fact Sheet And Calendar Morningstar

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax