us exit tax percentage

Legal Permanent Residents is complex. Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

In most cases it will be in one giant lump in the year that you give up your US.

. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation. Funds TSA at 560 per one-way up to 1120 per round trip was 250 per enplanement up to 500 per one-way trip from 2102 through 72014. These simplified single-issue examples are only for clarity.

The exit tax and the inheritance tax. It rises to 105900 for 2019 and 107600 for 2020. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the. As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. The Child Tax Credit remains 2000 for all three years with the refundable part that many expat parents can claim as a payment also staying the same at 1400 per child.

It rises to 12200 for 2019 and 12400 for 2020. The United States has a unified gift and estate tax system that applies to gifts made during life and bequests made at death. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Eligible deferred compensation items. Federal income tax rates range from 10 percent to 37 percent.

In direct answer to Ms question you will pay tax once and once only when you exit the United States. These rules and exceptions present some exit planning opportunities. Citizenship or long-term residency by non-citizens may trigger US.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. An expatriation tax is a tax on someone who renounces their citizenship. 1 737 205 6687.

In a few cases the tax will be imposed by 30 withholdings on payments to you forever and ever. Resident status for federal tax purposes. The expatriation tax consists of two components.

Federal income tax rates range from 10 percent to 37 percent. 6 NovemberDecember 2020 Pg 60 Gary Forster and J. In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal.

As a result of this election no subsequent distribution from the trust to the covered expatriate will be subject to 30 percent withholding Notice 2009-85 7D. Planning around the exit tax. The Basics of Expatriation Tax Planning.

For 2021 the highest estate and gift tax rate is 40 percent. One system of estate and gift taxation applies to US citizens and. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax.

Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act. The term expatriate means 1 any US. Currently net capital gains can be taxed as high as 238 including the net.

Since 51391 passenger fee and 2992 aircraft fee funds agricultural quarantine and inspection services conducted by CBP per 7 CFR 354. Expatriation from the United States. APHIS continues to perform.

Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Citizenship or green card. Youre going to get taxed by the IRS on that US1 million gain.

Finally here is Ms answer. The term expatriate means 1 any US. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. The Foreign Earned Income Exclusion threshold for 2018 was 103900. Exit Tax and Expatriation involve certain key issues.

Different rules apply according to. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Nepal Income Tax Slab Rates For Fy 2077 78 B S 2020 21 Income Tax Revenue Management Goods And Services

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

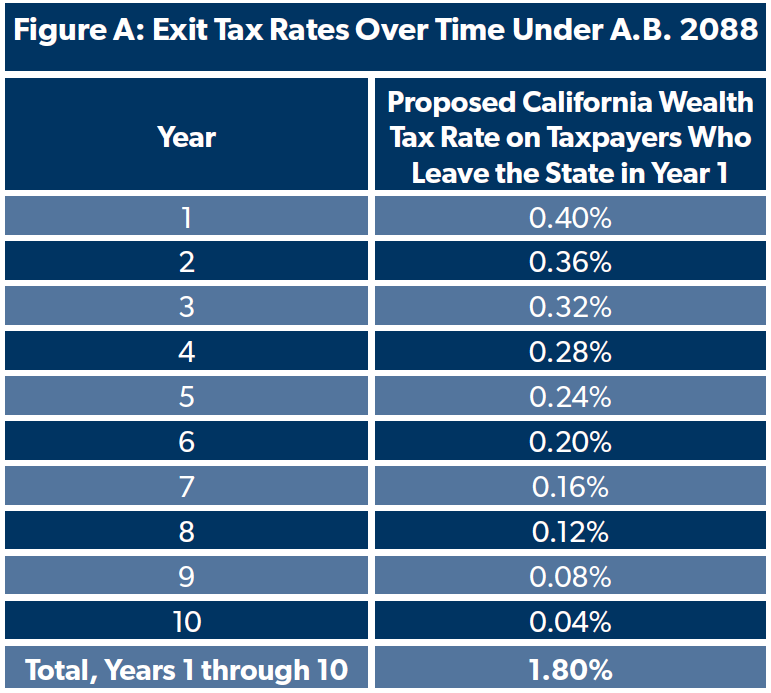

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Green Card Exit Tax Abandonment After 8 Years

What Are The Us Exit Tax Requirements New 2022

Exit Tax In The Us Everything You Need To Know If You Re Moving

What Are The Us Exit Tax Requirements New 2022

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Doing Business In Singapore Vs Hong Kong Singapore Hong Kong Business

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Samvat 2075 Was A Year Of Diis Sip Flows Helped Cushion Fii Outflow Hit Investing Books Dividend Investing Systematic Investment Plan

Renouncing Us Citizenship Expat Tax Professionals

Renounce U S Here S How Irs Computes Exit Tax

Exit Tax Us After Renouncing Citizenship Americans Overseas

Investing Archives Napkin Finance Investing Personal Finance Budget Finance Investing