city of chattanooga property tax increase

Chattanooga City Hall 101 E 11th St Room 100 Chattanooga TN 37402-4285-----Paying Property Taxes by Credit or Debit Card. The Office of the City Treasurer administers a.

But again the actual tax rate is.

. The increase raises some 30. PROPERTY TAX CREDIT DEBIT CARD OR E-CHECK PAYMENT. The property taxes levied on taxable property in the City are billed on October 1st of each year and are due without interest and penalty by the last day of February of the following year.

Actually tax rates cant be raised until the public is first notified of that plan. You may contact our office to verify the current amount by e-mail at ptaxchattanoogagov or call 423-643-7262. The funding plan which covers the fiscal year from July 1 2022 to June 31 2023 does not contain an increase to the citys property tax rate which will remain at 225 per 100 of.

Sales Tax 40 00 on food Property Tax Property tax or ad valorem tax is based on the value of real and personal property subject to the tax. To reach our Technical Assistance Center please call. The city of Chattanooga will rely on a proposed 30 million increase in property tax revenue for the budget year that.

CITY OF CHATTANOOGA TREASURY DEPARTMENT 101 E 11TH ST ROOM 100 CHATTANOOGA TN 37402-----PROPERTY TAX RELIEF PROGRAM. City workers would get a raise in Mayor Tim Kellys budget. The new certified tax rate for Chattanooga is 18529 per 100 of assessed value.

That increase in the citys portion of property taxes will equal about 30 million for this next Fiscal Year or an increase of 1959 in revenue. CHATTANOOGA WDEF Chattanoogas City Council unanimously approved a new budget Tuesday night that includes a 40-cent property tax hike. Updated September 28 2021 at 846 pm.

PROPERTY TAX CREDIT DEBIT CARD OR E-CHECK PAYMENT. 5 hours agoThe tenants are protesting a property tax. In establishing its tax rate Chattanooga must comply with the state Constitution.

That increase in the citys portion of property taxes will equal about 30 million for this next Fiscal Year or an increase of 1959 in revenue. The city is decreasing the property tax rate to one of the lowest rates in 50. The Office of the City Treasurer administers a.

Information Technologies provides enterprise wide business and technology solutions for the City of Chattanooga local government. The tax rate under the Kelly budget would be 225 - 40 cents above the certified tax rate. But again the actual tax rate is.

Hamilton County tax increase. Tuesday September 7 2021. Chattanooga City Hall 101 E 11th St Room 100 Chattanooga TN 37402-4285-----Paying Property Taxes by Credit or Debit Card.

If a Chattanooga home was previously appraised at 100000 but its value increased to 110000 after the recent reappraisal the owner will pay 49 more in city property taxes. It includes a property tax rate of 225 per 100 in a homes assessed value which the city estimates will provide a 30 million increase in revenue. Search Map Group Parcel Owner Name Bill Number Property Address.

The new certified tax rate for Chattanooga is 18529 per 100 of assessed value. The City Council on Tuesday night unanimously approved a 40-cent property tax increase above the new certified rate. CITY OF CHATTANOOGA TREASURY DEPARTMENT 101 E 11TH ST ROOM 100 CHATTANOOGA TN 37402-----PROPERTY TAX RELIEF PROGRAM.

Then a formal meeting. The tax rate under the Kelly budget will be 225 - 40 cents above the certified tax rate.

Clarksville Mayor Proposes 20 Cent Property Tax Increase

Popeyes Chattanooga Tn Chattanooga Tennessee

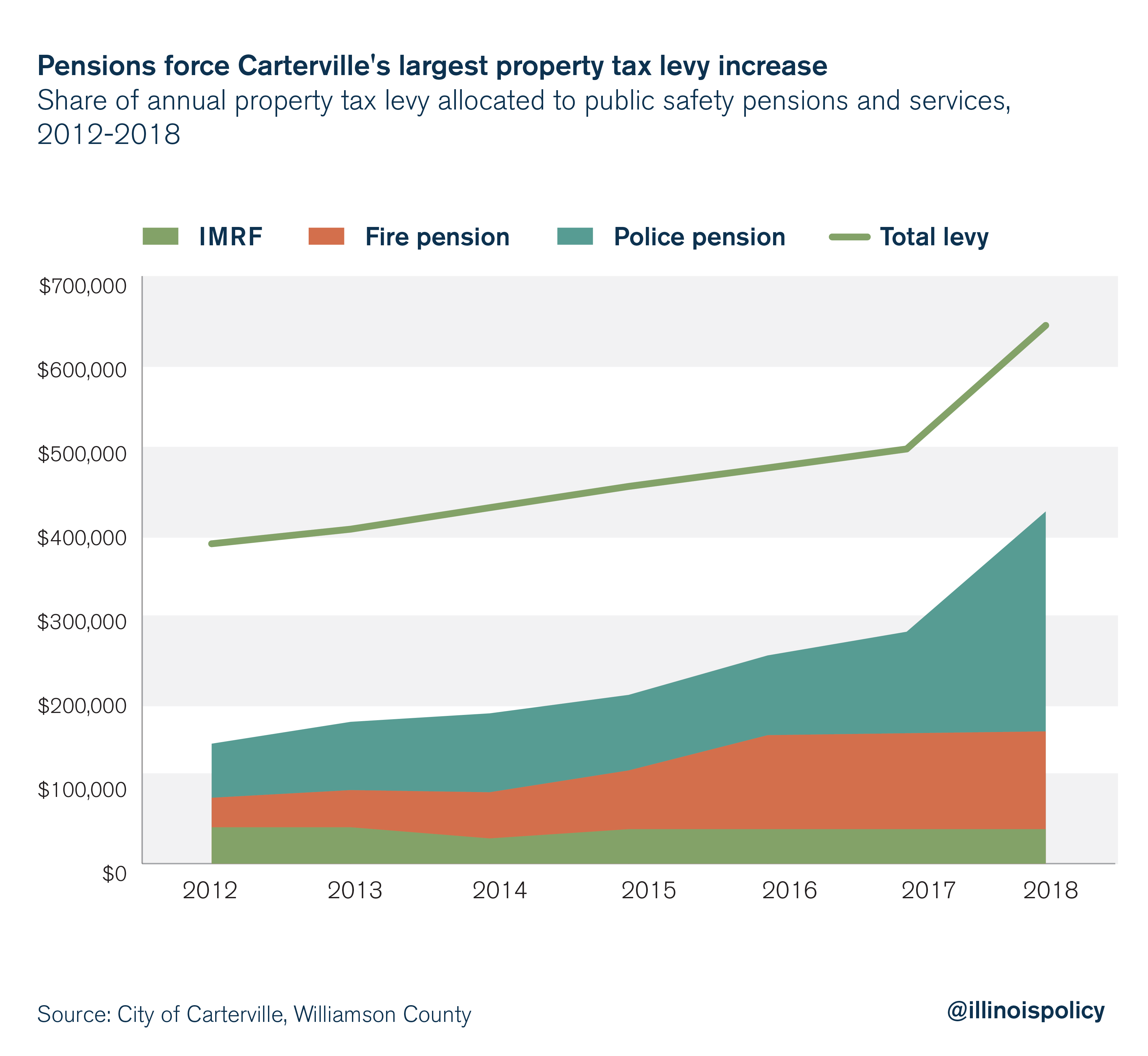

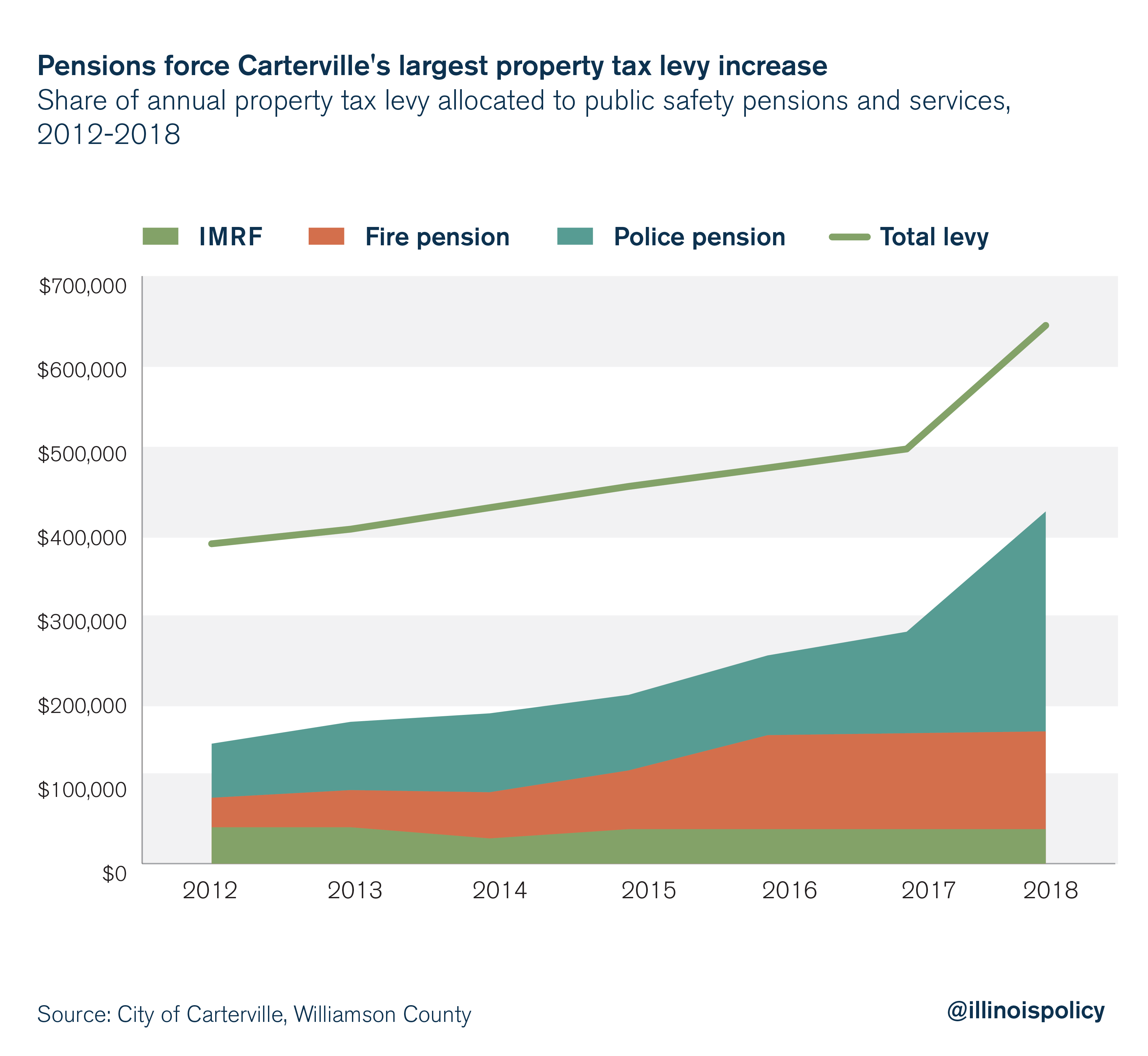

Carterville Passes Largest Property Tax Hike In City History To Pay For Pensions

Lookout Mountain Ga Considering 3 Property Tax Increase Fairyland School Facing Virus Funding Issues Chattanoogan Com

Red Bank Commissioners Approve Property Tax Increase In First Reading Icymi Local3news Com

Chattanooga Hamilton County Tn Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Chattanooga City Council Approves New Budget With Property Tax Increase Wdef

City Council Unanimously Approves Budget On 2nd Reading That Includes 40 Cent Property Tax Increase Chattanoogan Com

Nashville Mayor Property Tax To Be Cut Significantly To Where It Was 2 Years Ago Wztv

Increased Property Values Mean Different Things For Property Taxes

Property Tax Increases Planned For Catoosa County S New Budget Chattanooga Times Free Press

Little Rock Property Tax How Does It Compare To Other Major Cities

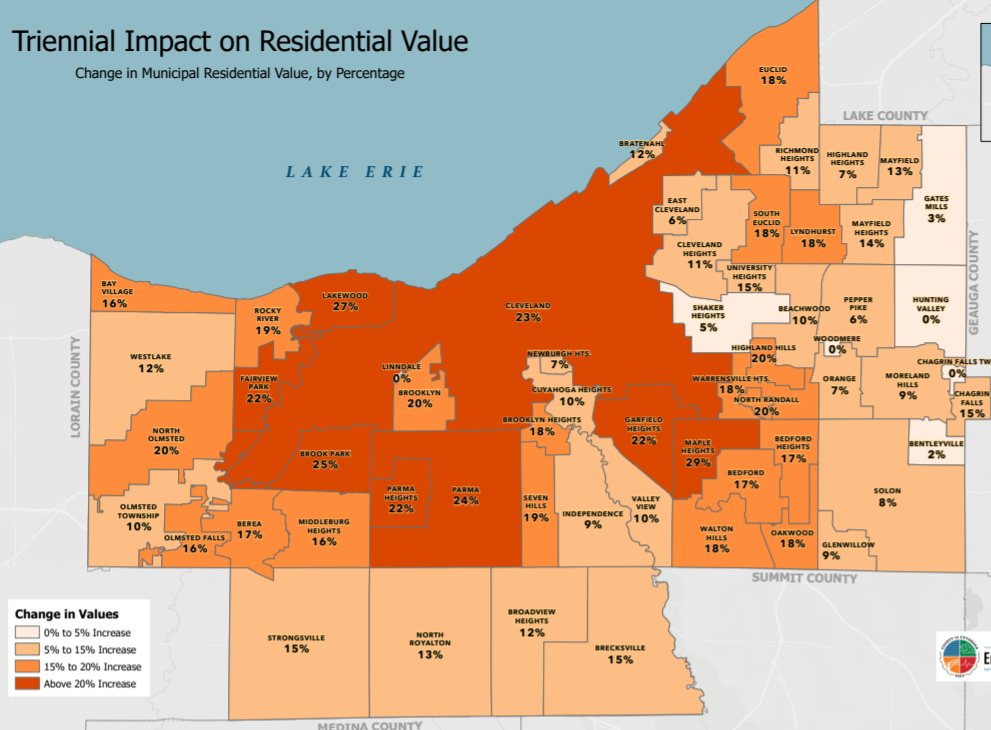

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America

Your Money How Much More Chattanoogans Will Pay In Property Taxes Where The Money Goes Wtvc

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

Chattanooga Hamilton County Tn Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Chattanooga Hamilton County Tn Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Chattanooga And Hamilton County Tax Calculator Metro Ideas Project